How Buying a New Home Could Save You Thousands in Utah's Real Estate Market

In the evolving landscape of Utah real estate, purchasing a brand-new home no longer means paying a premium. Thanks to builder-paid interest rate buydowns, buyers now have an opportunity to save tens of thousands of dollars, especially in the initial years of homeownership. This shift presents a compelling option for prospective homeowners weighing their choices between new constructions and existing homes. Understanding the financial benefits, market incentives, and practical considerations is essential for making an informed decision in Utah's competitive market.

The Financial Advantage of Buying New

Historically, buyers paid more for brand-new homes due to their modern features and untouched condition. However, recent market dynamics have changed this paradigm. In many Utah regions, including the greater Salt Lake City area and surrounding suburbs, home builders face increased inventory and affordability challenges. To attract buyers, builders are offering substantial incentives, including deeply discounted interest rates through programs known as interest rate buydowns.

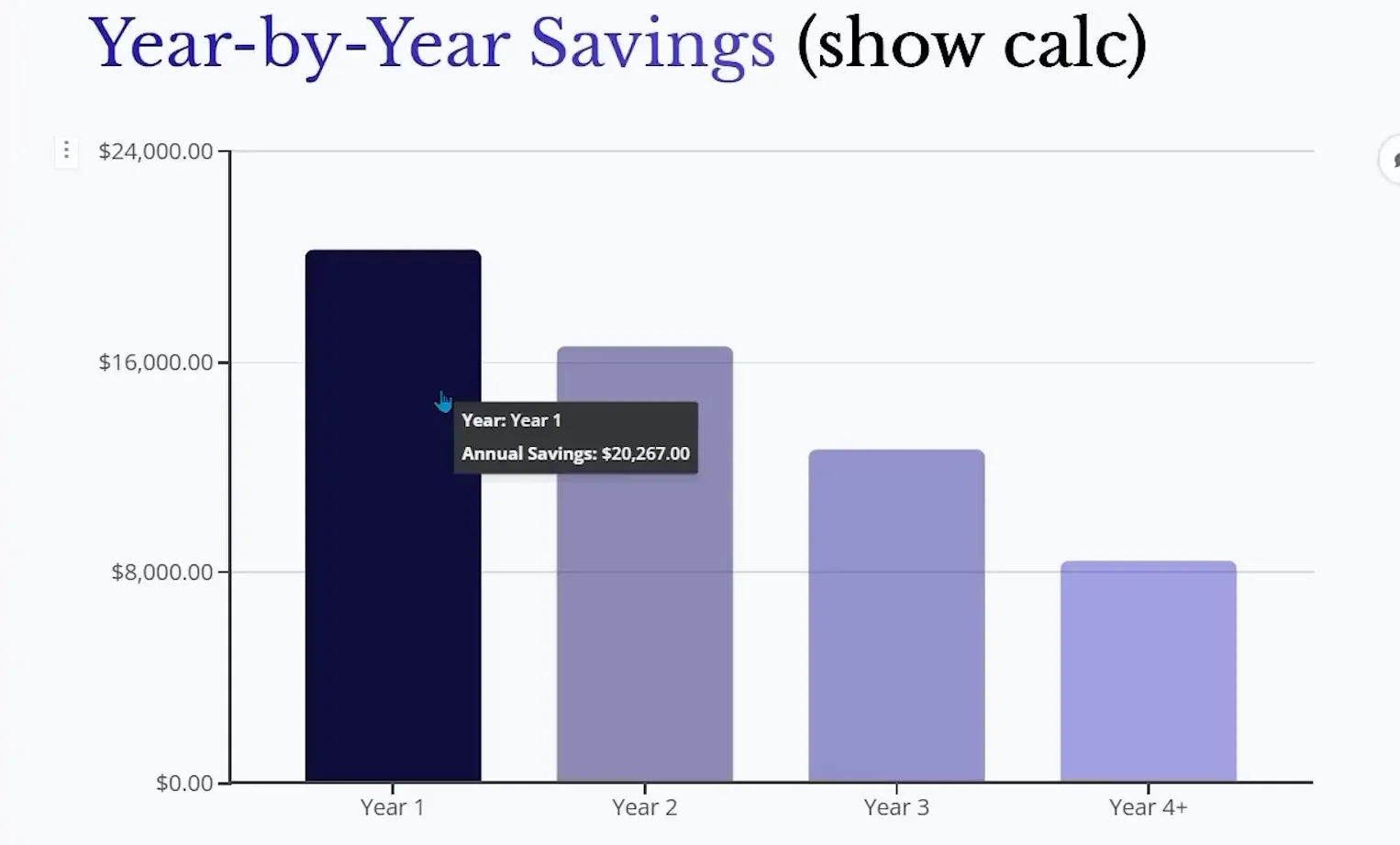

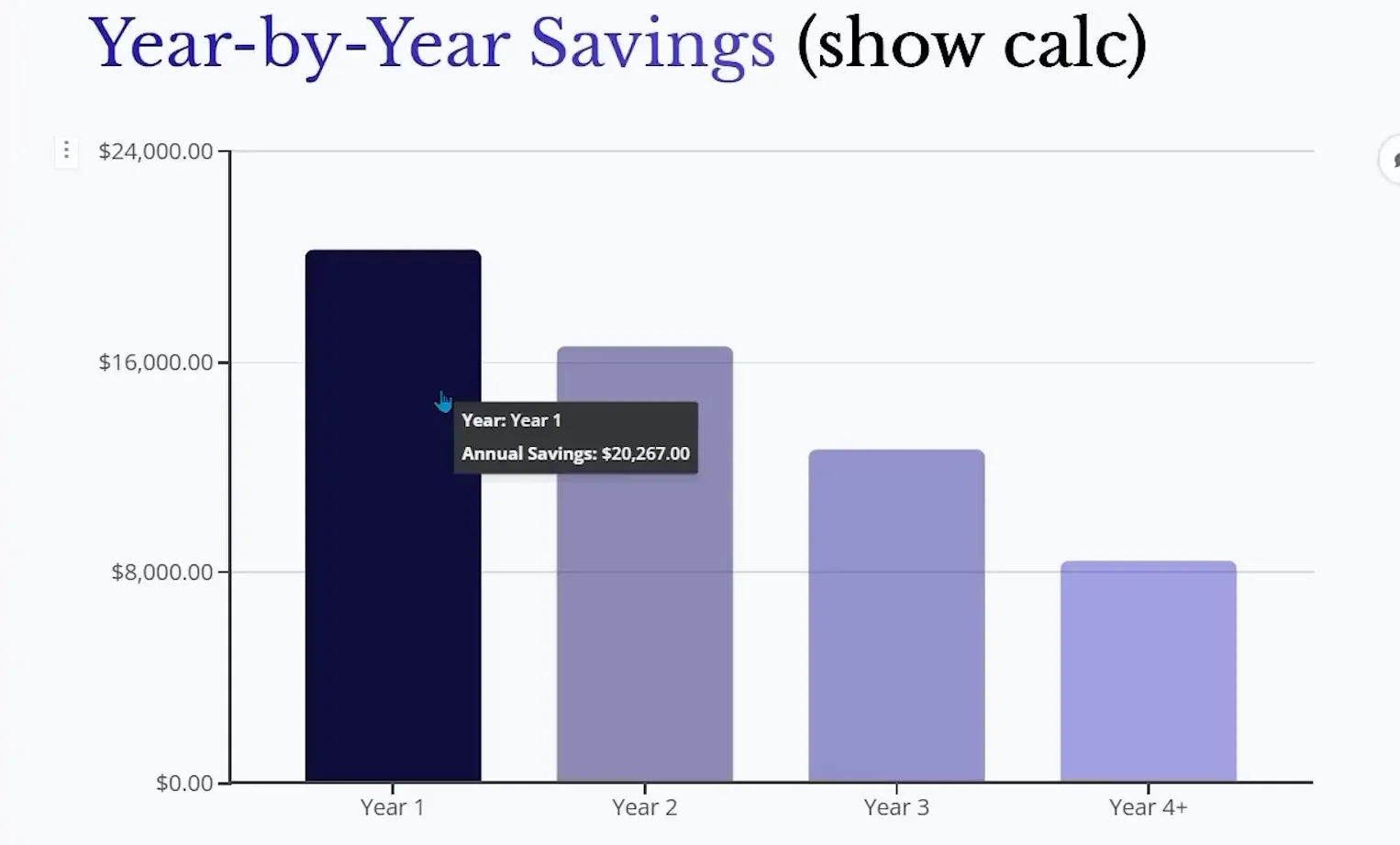

For instance, a typical new home priced at around $737,000 with a 20% down payment could qualify for a “3-2-1 buy down” interest rate structure:

- Year 1: 1.99% interest rate

- Year 2: 2.99% interest rate

- Year 3: 3.99% interest rate

- Years 4-30: 4.99% interest rate fixed

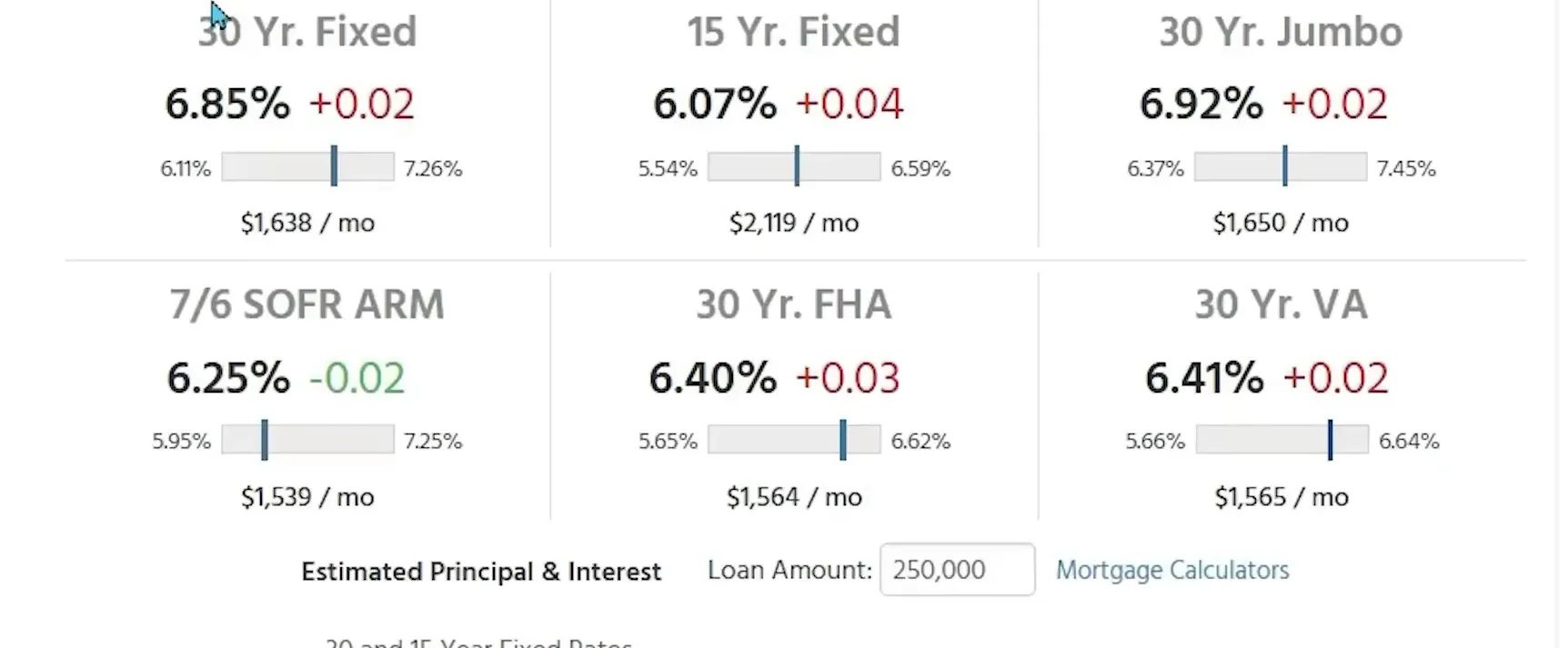

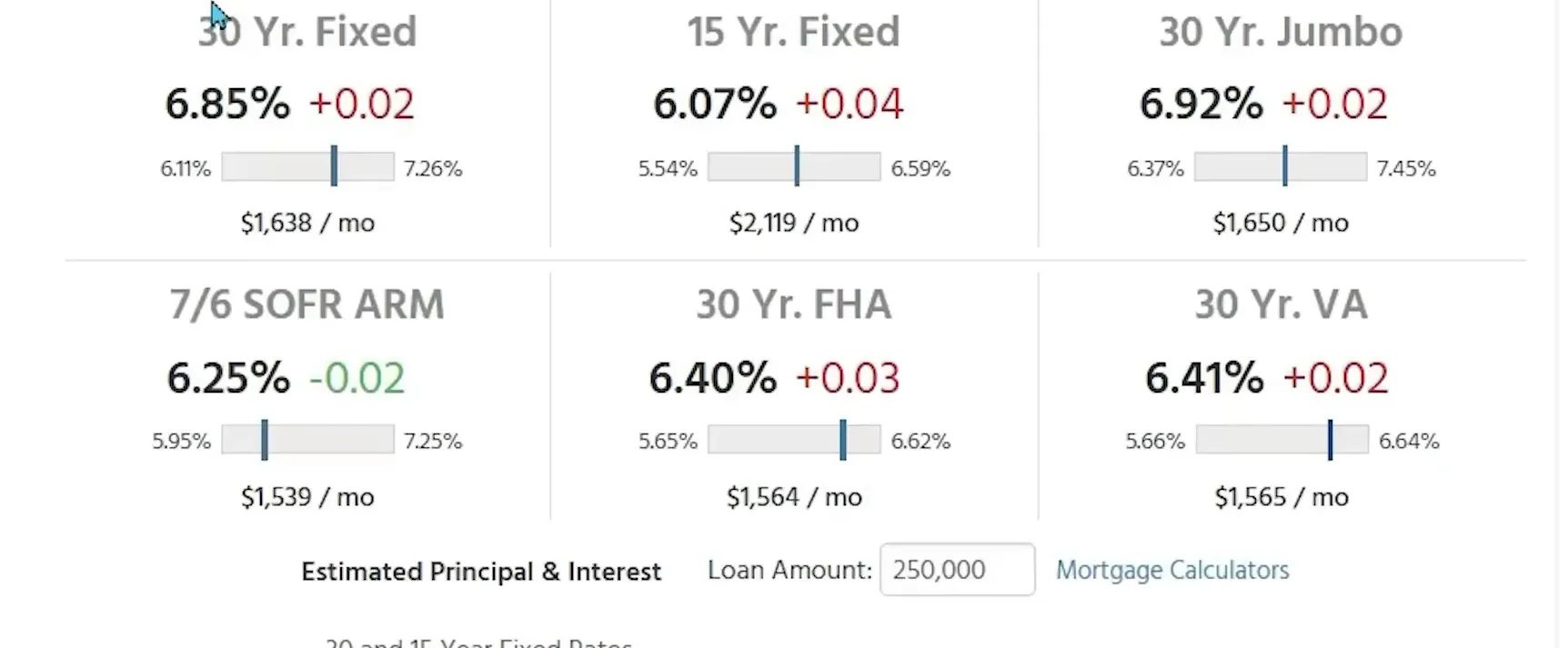

Compare this to the current average mortgage rates for existing homes, which hover around 6.85%, and the savings become clear. Monthly principal and interest payments on a new home with the buy down could start at approximately $2,200, while an older home at current rates might cost about $3,867 per month. This translates to annual savings exceeding $20,000 in the first year alone and tens of thousands over the subsequent years.

Explore Utah Real Estate

83 W 850 S, Centerville, UT

$815,000

Bedrooms: 5 Bathrooms: 3 Square feet: 3,999 sqft

653 E RYEGRASS DR #305, Eagle Mountain, UT

$387,900

Bedrooms: 3 Bathrooms: 3 Square feet: 1,985 sqft

2098 E GOOSE RANCH RD, Vernal, UT

$103,000

Square feet: 274,864 sqft

Over the first four years, buyers could save nearly $58,000 in mortgage payments alone, with continued savings of over $8,400 annually thereafter until refinancing becomes feasible at lower rates. These figures exclude property taxes, insurance, or homeowners association (HOA) fees, but even with these costs considered, new homes often remain more cost-effective.

Understanding Builder Incentives and Market Trends in Utah

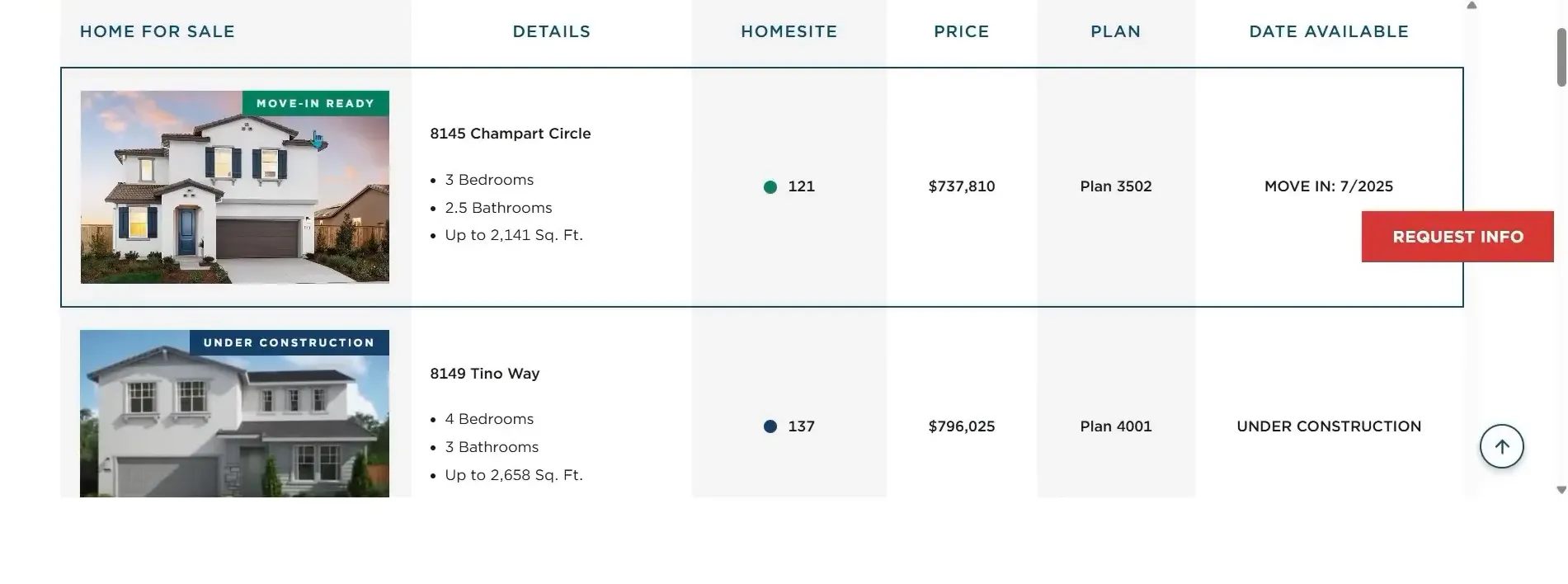

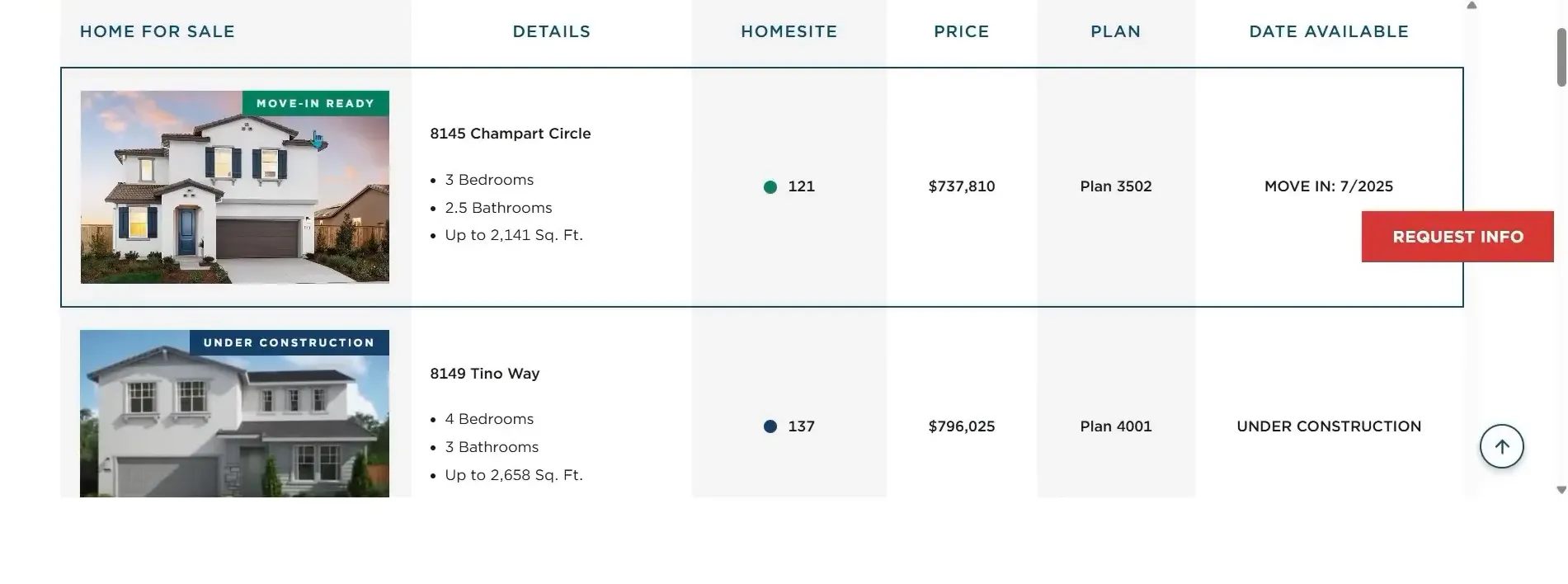

Builder incentives are becoming more common in Utah’s new home developments, especially for move-in-ready homes. These incentives include not only interest rate buydowns but also closing cost credits and price reductions off the asking price. For example, some builders have accepted offers $40,000 below the initial listing price to move inventory quickly.

Prospective buyers should focus on completed homes rather than those still under construction or on dirt lots. Builders are more motivated to sell finished homes since the sunk costs of labor and materials have already been incurred, making these homes more likely to be offered at attractive prices and financing terms.

More Properties You Might Like

2148 E GOOSE RANCH RD, Vernal, UT

$116,000

Square feet: 309,276 sqft

2031 N LAVA ROCK CIR #107, St George, UT

$4,185,000

Bedrooms: 4 Bathrooms: 5 Square feet: 5,404 sqft

6668 S 3200 W, Spanish Fork, UT

$2,074,000

Bedrooms: 3 Bathrooms: 3 Square feet: 2,560 sqft

Sites like NewHomeSource.com provide valuable listings and incentive details, allowing buyers to evaluate options and calculate potential savings.

Pros and Cons of Buying New Homes in Utah

Pros

- Builder Incentives: Lower interest rates, closing cost credits, and price negotiations can make new homes financially attractive.

- Modern Features and Energy Efficiency: New homes incorporate the latest building codes and energy-efficient technologies, reducing utility costs.

- Lower Maintenance Costs: Everything is brand new, from the roof to the HVAC system, minimizing unexpected repair expenses.

- Builder Warranties: Typically including a 10-year warranty on structural components and a 1-year warranty on finishes and systems, offering peace of mind.

- Customization: For homes not yet built, buyers can select finishes, cabinetry, flooring, and paint to suit personal preferences (though this usually increases cost).

Cons

- Location: New developments are often on the outskirts of cities, potentially farther from amenities, workplaces, and entertainment.

- Less Mature Neighborhoods: Landscaping, community features, and infrastructure may still be developing.

- Smaller Lot Sizes: While some Utah builders offer half-acre lots, many new homes have smaller yards compared to older properties.

- HOA and Mello Roos Taxes: Some new communities include homeowners associations with regulations and fees, as well as additional property tax assessments (like Mello Roos in California, similar fees may apply in other states).

- Construction Delays: Though less common now, supply chain issues can still occasionally delay completions.

Tips for Utah Homebuyers Considering New Construction

- Target Move-In Ready Homes: Buyers get the best deals and incentives on completed homes where builders are motivated to close sales quickly.

- Work with a Buyer’s Agent: Avoid working directly with builder sales representatives, who prioritize the builder’s interests and maximum price. A buyer’s agent advocates for the purchaser and is often paid by the builder.

- Evaluate Interest Rate Buydowns Carefully: Confirm that the final mortgage rate after the buydown period remains competitive and affordable. Beware of temporary rate reductions that revert to high rates later.

- Plan for the Long Term: Buy with a stable job, emergency savings, and an intent to stay in the home for at least 5-10 years to maximize financial benefits.

- Compare Offers on Existing Homes: Sellers may offer closing cost credits to reduce upfront expenses, but expect current mortgage rates without significant buydowns.

Applying These Insights to Utah’s Real Estate Market

Utah’s real estate market offers a wide range of opportunities for buyers, from established neighborhoods in Salt Lake City and Provo to growing communities in St. George and Park City. New home construction is particularly active in suburban areas where builders compete to attract buyers with incentives and flexible financing.

Prospective buyers should leverage tools like Best Utah Real Estate to explore listings, compare neighborhoods, and connect with knowledgeable local agents. Understanding the financial mechanics behind interest rate buydowns and builder incentives can help buyers make strategic choices that align with their long-term goals.

Conclusion

For buyers in Utah’s dynamic real estate market, new homes offer a compelling financial advantage through builder-paid interest rate buydowns and other incentives. While location and community maturity may differ from established neighborhoods, the long-term savings, modern features, and warranties make new construction an attractive option for many. Careful evaluation of mortgage terms, builder incentives, and personal financial readiness will ensure a successful home purchase that aligns with lifestyle and investment goals.

Frequently Asked Questions

What is an interest rate buydown, and how does it work?

An interest rate buydown is a financing incentive where the builder pays to temporarily reduce the mortgage interest rate, lowering monthly payments for the first few years. This helps buyers afford a new home despite higher baseline rates.

Are new homes always more expensive than existing homes?

Not necessarily. While new homes traditionally cost more, current builder incentives and interest rate buydowns can make new homes financially competitive or even cheaper in the short term compared to existing homes.

What should buyers watch out for in builder incentives?

Buyers should ensure the final mortgage rate after any buy down period is affordable and competitive. Temporary low rates can increase substantially, so budgeting for the eventual payment is critical.

Do new homes in Utah typically have homeowners association (HOA) fees?

Many new developments include HOAs that manage community amenities and maintenance. Fees vary widely, so buyers should review HOA bylaws and costs before purchasing.

How do property taxes affect the cost of new homes?

New homes may include additional property tax assessments to fund local infrastructure. These fees can add to annual costs but are often offset by lower maintenance and energy expenses.