Buying a home in Utah's current market can be challenging, but there may be opportunities to find a great deal on a foreclosed property. In this blog, we'll explore the process of finding and purchasing a foreclosed home in Utah, including tips on working with professionals, understanding the details, and ensuring your financing is in order.

Foreclosed Homes Have Been Rare

Foreclosed homes have been a rarity in the Utah market recently. This scarcity has been driven by several factors, primarily the significant increase in property values.

Market Trends

Over the past few years, Utah has seen a substantial rise in property values. In some cases, property values have increased by as much as 26% in a single year. This rapid appreciation has made it difficult for homeowners to lose their properties due to foreclosure.

Equity Cushion

With such high equity, homeowners have more options to avoid foreclosure. They can sell their homes quickly if they face financial distress, making foreclosures less common. This equity cushion acts as a safety net, preventing many homes from entering the foreclosure process.

Hidden Opportunities

People buying homes in Utah in cases of foreclosure may consider it a daunting process, but the right information changes the whole process. When it comes to discussing properties or trying to find investment opportunities, something as simple as an APA generator can go a long way in making your paperwork and reports easier to create.

Despite the rarity, opportunities do exist. Homeowners in financial distress may not always be forthcoming about their situation. This reluctance can lead to hidden gems in the market for those who know where to look.

Work with Someone Familiar with Foreclosures

When navigating the complexities of buying foreclosed Utah properties, it's crucial to work with someone experienced in this niche market.

Expert Guidance

Working with a real estate professional who understands foreclosed properties can make a significant difference. They bring valuable insights and experience to the table, ensuring you make informed decisions.

Market Knowledge

Professionals familiar with foreclosures have a deep understanding of the market dynamics. They can help you identify potential opportunities and avoid common pitfalls. This knowledge is invaluable when seeking the best deals on foreclosed properties.

Property Assessment

Foreclosed properties often come with unique challenges. A seasoned professional can assess the condition of the property, identify necessary repairs, and estimate renovation costs. This assessment ensures you have a clear picture of the investment required.

Explore Utah Real Estate

544 W 2900 SOUTH, Bountiful, UT

$470,000

Bedrooms: 4 Bathrooms: 3 Square feet: 2,344 sqft

1792 E SKYLINE DR #G 5, Eagle Mountain, UT

$308,000

Bedrooms: 2 Bathrooms: 2 Square feet: 1,530 sqft

243 S 1400 W, Spanish Fork, UT

$495,000

Bedrooms: 3 Bathrooms: 3 Square feet: 2,300 sqft

Legal and Financial Aspects

Foreclosure transactions involve specific legal and financial considerations. An experienced professional can guide you through these complexities, ensuring a smooth and legally sound transaction.

Understand the Details

It's important to thoroughly understand the details of foreclosed properties before making an offer.

Property Condition

Foreclosed homes often sit vacant for extended periods, leading to maintenance issues. It's crucial to inspect the property thoroughly to identify any problems. Be prepared for potential repairs, ranging from minor cosmetic fixes to major structural issues.

Liens and Encumbrances

Foreclosed properties may have liens or other encumbrances that need to be cleared before purchase. Understanding these details is essential to avoid unexpected financial burdens. A title search can reveal any outstanding liens on the property.

As-Is Sales

Most foreclosed properties are sold "as-is," meaning the seller (often a bank) won't make any repairs. This condition underscores the importance of thorough inspections and accurate cost estimates for necessary repairs.

Timeline Considerations

The foreclosure process can be lengthy and unpredictable. Be prepared for potential delays and have patience as the transaction progresses. Understanding the timeline helps manage expectations and plan accordingly.

Get Your Financing In Order

Having your financing in order is critical when pursuing foreclosed properties.

Pre-Approval is Essential

Before you start looking at foreclosed properties, get pre-approved for a mortgage. This pre-approval demonstrates to sellers that you're a serious buyer with the financial capability to complete the purchase.

Cash Offers Are King

In the foreclosure market, cash offers often have a significant advantage. If possible, consider making a cash offer to increase your chances of acceptance. Banks prefer cash offers because they close faster and have fewer contingencies.

More Properties You Might Like

3233 S YANSA Trail, Hurricane, UT

$900,000

Bedrooms: 4 Bathrooms: 5 Square feet: 2,769 sqft

2426 N NECTAR WAY, Saratoga Springs, UT

$585,000

Bedrooms: 6 Bathrooms: 3 Square feet: 2,520 sqft

80 N CENTER, Eureka, UT

$285,000

Bedrooms: 3 Bathrooms: 1 Square feet: 1,112 sqft

Financing Options

If you're not making a cash offer, explore various financing options. Some loans, like FHA 203(k) loans, allow you to finance both the purchase and renovation costs. Understanding these options can expand your opportunities in the foreclosure market.

Budget for Repairs

When determining your financing needs, don't forget to budget for repairs and renovations. Having a clear financial plan that includes these costs ensures you won't be caught off guard after purchase.

The Foreclosure Buying Process

Understanding the foreclosure buying process can help you navigate it more effectively.

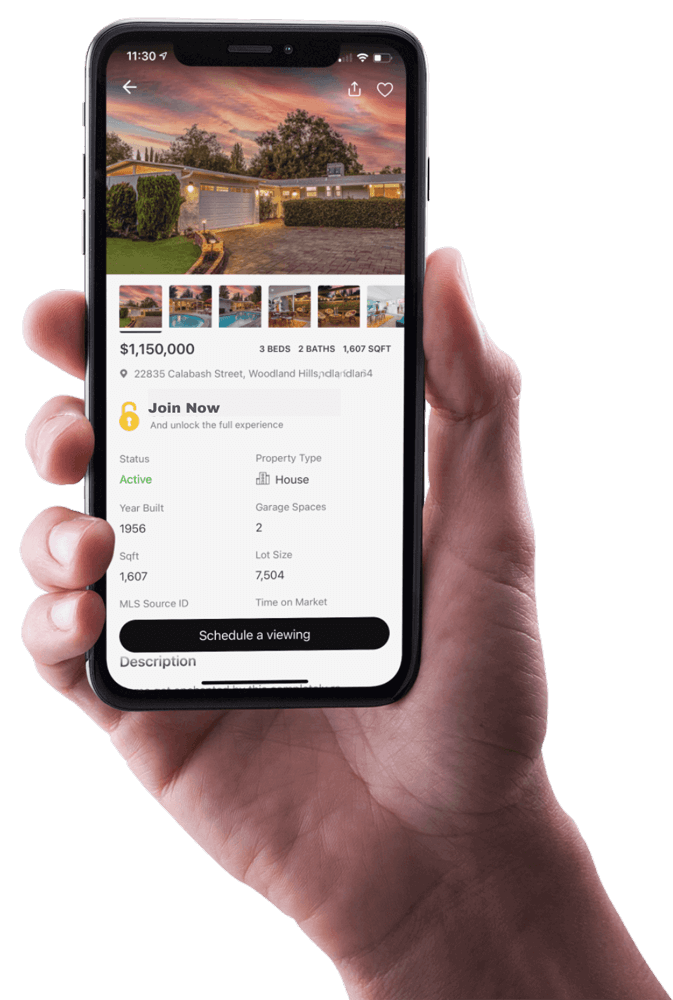

Finding Foreclosed Properties

Foreclosed properties can be found through various channels, including MLS listings, bank websites, government agencies, and foreclosure auction sites. Working with a real estate professional can help you access these resources more efficiently.

Making an Offer

When making an offer on a foreclosed property, be prepared for competition. Strong offers with minimal contingencies and quick closing times are more likely to be accepted. Your real estate professional can help you craft a competitive offer.

Due Diligence

Once your offer is accepted, conduct thorough due diligence. This includes professional inspections, title searches, and reviewing all available documentation. Don't skip this crucial step, even if time is limited.

Closing the Deal

The closing process for foreclosed properties can differ from traditional sales. Be prepared for potential delays and have flexibility in your timeline. Working with experienced professionals can help ensure a smooth closing.

Conclusion

While foreclosed homes have been rare in Utah's hot market, opportunities still exist for savvy buyers. By working with experienced professionals, understanding the details, and having your financing in order, you can successfully navigate the foreclosure market and potentially find a great deal on your next home. Remember, patience and preparation are key when pursuing foreclosed properties in Utah.

Foreclosure Properties in Utah

544 W 2900 SOUTH, Bountiful, UT

$470,000

Bedrooms: 4 Bathrooms: 3 Square feet: 2,344 sqft

1792 E SKYLINE DR #G 5, Eagle Mountain, UT

$308,000

Bedrooms: 2 Bathrooms: 2 Square feet: 1,530 sqft

243 S 1400 W, Spanish Fork, UT

$495,000

Bedrooms: 3 Bathrooms: 3 Square feet: 2,300 sqft

3233 S YANSA Trail, Hurricane, UT

$900,000

Bedrooms: 4 Bathrooms: 5 Square feet: 2,769 sqft

2426 N NECTAR WAY, Saratoga Springs, UT

$585,000

Bedrooms: 6 Bathrooms: 3 Square feet: 2,520 sqft

80 N CENTER, Eureka, UT

$285,000

Bedrooms: 3 Bathrooms: 1 Square feet: 1,112 sqft