How Plumbing Conditions Influence Property Value and Buyer Confidence

Plumbing systems play a key role in home inspections, buyer confidence, and long-term property value. Learn how infrastructure impacts real estate decisions.

Determining when to buy a new home isn't always the easiest decision. While scrolling through property listings or attending open houses can spark excitement, timing influences whether buying is wise.

Various factors affect the ideal timing for homeownership, from personal finances to market conditions. Understanding key indicators helps buyers recognize when circumstances align favorably for making this significant investment.

Financial readiness stands as the most critical indicator for timing a home purchase. This means having a stable income that comfortably covers monthly mortgage payments while leaving room for other expenses and savings.

A strong down payment, typically 10-20% of the home's price, demonstrates serious commitment and often secures better loan terms. Emergency funds covering 3-6 months of expenses provide essential protection against unexpected costs that accompany homeownership.

Credit scores above 650 unlock better mortgage rates, though scores above 740 yield the most favorable terms. Debt-to-income ratios below 43% show lenders that monthly obligations won't strain finances.

Local real estate markets fluctuate between favoring buyers and sellers. Buyer's markets emerge when inventory exceeds demand, creating opportunities for negotiation and better prices.

Key signs of favorable market conditions include:

Seasonal patterns also affect timing. Spring typically brings more inventory but increased competition. Fall and winter often present fewer options but motivated sellers.

Personal stability creates the foundation for successful homeownership. Job security, ideally with two years in the same position or field, reassures lenders and provides confidence in maintaining payments.

Planning to stay in an area for at least five years allows time to build equity and offset transaction costs. Major life changes like marriage, divorce, or career shifts ideally settle before taking on homeownership responsibilities.

Family planning considerations matter too. Growing families may need different spaces than singles or couples, affecting both timing and property selection.

Beyond the three primary signs, several factors influence optimal timing. Tax benefits from mortgage interest deductions may offset some ownership costs, particularly for higher earners.

Rental market conditions matter when current rent approaches potential mortgage payments. Building equity instead of paying rent becomes increasingly attractive as rental costs rise.

Age plays a role, though no perfect age exists for buying. Younger buyers gain decades for appreciation and mortgage payoff. Older buyers often bring larger down payments and clearer lifestyle preferences.

Rushing into homeownership before achieving financial stability creates stress and potential hardship. Fear of missing out (FOMO) during hot markets leads to overpaying or compromising on important features.

Timing purchases around expected windfalls like bonuses or inheritances proves risky if funds don't materialize. Similarly, buying based on future income rather than current earnings stretches budgets dangerously thin.

Ignoring total ownership costs beyond mortgage payments causes budget shortfalls. Property taxes, insurance, maintenance, and utilities significantly impact monthly expenses.

Preparing for homeownership typically requires 6-24 months. This timeline allows for:

Starting preparation early provides flexibility to wait for optimal conditions rather than forcing purchases under pressure.

The right time to buy ultimately balances personal readiness with market opportunities. When financial stability, favorable market conditions, and life circumstances align, confident buyers can proceed knowing they've chosen wisely.

Regular evaluation of these factors helps identify when timing shifts from "not yet" to "now's the time." Patience in waiting for proper alignment pays dividends through decades of successful homeownership.

Working with experienced real estate professionals provides valuable perspective on both personal readiness and market timing. Their insights help buyers recognize opportunities while avoiding costly mistakes.

Remember that perfect timing rarely exists. Good timing, however, happens when preparation meets opportunity. Focus on controlling personal factors while staying informed about market conditions to recognize your optimal moment for homeownership.

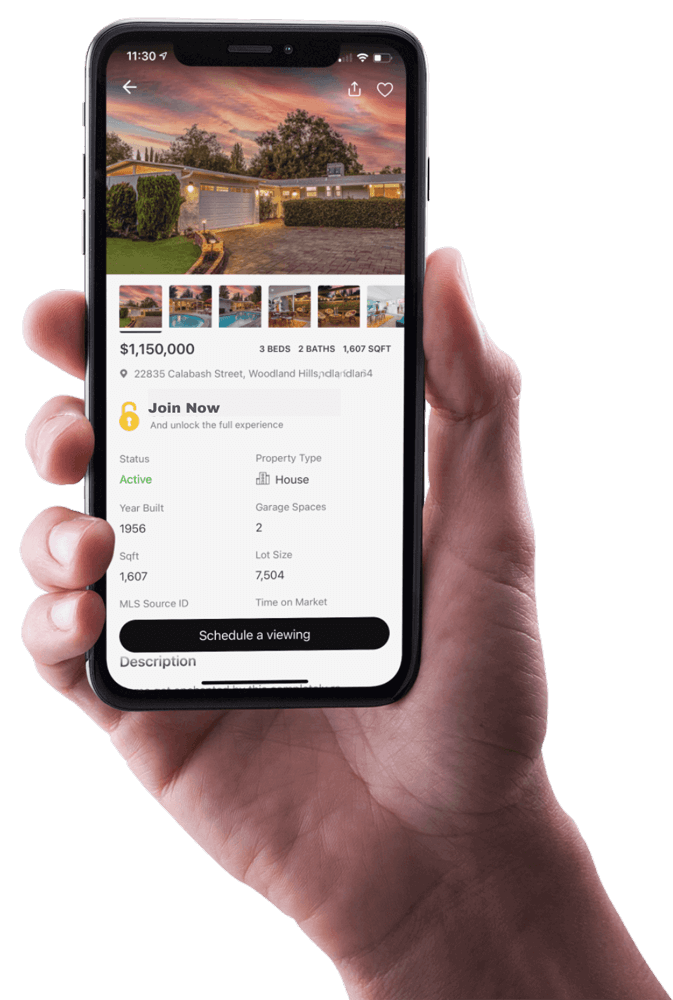

Access all your saved properties, searches, notes and more.

Access all your saved properties, searches, notes and more.

Enter your email address and we will send you a link to change your password.

Your trusted MLS search companion